These house guarantee fund fulfill a desire currently made by individual avenues

- New Day-after-day Bowl

- Browse

- Push

- About AAF

- Occurrences

- Benefits

This type of house collateral financing see a wants already prepared by personal places

- Freddie Mac computer looked for recognition from the Federal Property Financing Company (FHFA) to begin buying and encouraging finalized-avoid house security money to own consumers where Freddie currently possesses this new first mortgage.

- Brand new product might be inconsistent having Freddie Mac’s mission, replicate characteristics for sale in the private markets, risk exacerbating inflation demands, improve inequality, and worsen the financing dangers in private-market lending.

- The FHFA is always to reject Freddie Mac’s requested recognition.

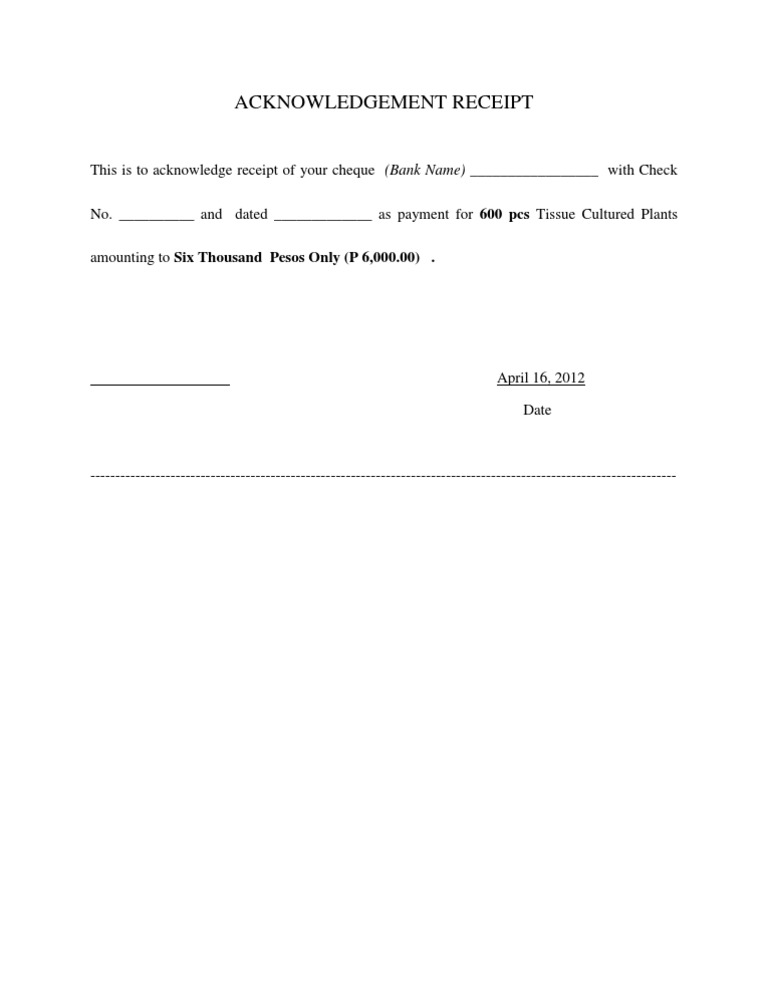

With the April sixteen, Freddie Mac tried recognition throughout the Government Homes Fund Service (FHFA) to start to get and you can promising signed-end home equity money for borrowers in which Freddie currently possess the latest first mortgage. The newest processing suggests that the new proposal’s definitive goal is always to give borrowers which have a lowered-costs replacement a cash-away re-finance. As the outlined less than, it has nothing in connection with new core housing purpose away from Freddie Mac computer. At exactly the same time, the fresh new suggestion has several most other defects and you will disadvantages which will head the fresh new FHFA so you can deny recognition.

(3) render constant assist with the latest additional marketplace for residential mortgages (plus issues in accordance with mortgages into the construction to possess reasonable- and moderate-earnings group related to a good economic come back that is certainly faster than the go back won to the other items) because of the enhancing the liquidity away from financial investment and you may raising the distribution regarding investment capital designed for home-based mortgage financial support; and you will

(4) offer use of home loan borrowing from the bank from the Nation (in addition to main locations, rural portion, and underserved portion) of the enhancing the exchangeability off home loan investments and increasing the shipment away from investment capital available for domestic mortgage financial support.

Domestic equity finance also called next mortgages allow home owners to turn on the bucks a number of the equity one has established right up inside their land. Allowing current people to spend a fraction of the housing collateral does not progress all five reason for Freddie Mac.

Similar goods are given by individual lenders, funded because of the private financing, and you can accustomed financing family-improvement methods or any other biggest expenses. Freddie Mac is within conservatorship and you may functionally an agency of one’s national. The first attempt out of a possible authorities input is whether there try a private-business market incapacity. Freddie Mac contends so it would provide a cheaper way to offer entry to guarantee, but there’s zero duty with the bodies to subsidize all the personal activity. There’s absolutely no compelling rationale because of it offer.

FHFA is refute this new Freddie Mac computer proposal, particularly in white regarding historically high rising prices, since individual purchasing that could be enabled of the offer would offer a counterproductive request stimuli. A number of source between advocates so you can analysts payday loans without bank account in Snowmass Village have estimated that there’s between $800 million and you can $step one.5 trillion in prospective household security funds. It assumes on one Federal national mortgage association employs Freddie Mac’s lead, if the Freddie Mac proposition is approved, it appears quite likely you to definitely Federal national mortgage association will abide by match.

Its slightly not sure how large the newest stimuli might possibly be. The top bound ‘s the $1.5 trillion guess, which would competitor new detrimental impression of Biden Administration’s 2021 Western Save your self Plan one to totaled $step one.9 trillion one an element of the policy errors you to definitely caused rising prices to dive in one.cuatro % to nine.1 percent. Obviously, a few of the house equity is cashed-away playing with personal industry loans, therefore a lower likely is provided from the extra equity cashed-out making use of the suggested tool.

Anyhow, the danger is actually for often an acceleration of inflation otherwise an effective a whole lot more draconian Federal Set aside rules in order to counterbalance the request. At this juncture, highest rates of interest could well be definitely bad for Freddie Mac’s property purpose.

It is alarming one to Freddie Mac computer manage follow an effort during the potential with housing collateral. The prospective customer base of these money was wealthy citizens which have high construction collateral and you can a low credit chance. (Obviously, taking right out a whole lot construction security would generate most chance.)

Fundamentally, the latest flip side of the plan would be large filters in the credit places. Private loan providers usually do not contend with new words given by a beneficial 20-seasons, fixed-rate tool. Best wishes risks tend to move out of personal consumer loan providers in order to Freddie and you will Fannie, therefore the banking industry and other lenders would be saddled that have a great riskier guide out-of organization. The risk should be counterbalance that have highest interest levels with the private-markets affairs, showing might inequity of one’s offer.

That is an excellent quantitatively very important issuepass Part Research quotes one, in the fourth one-fourth away from 2023, unsecured debt excluding student loans totaled $step three.six trillion. For this reason, top of the-sure guess comprises about you to-1 / 2 of user borrowing from the bank. Even a smaller displacement away from credit rating would have a dramatic effect on the fresh structure off personal credit dangers.

Freddie Mac computer s advised new service could be inconsistent along with its mission, simulate characteristics available in the personal industry, chance exacerbating rising prices pressures, boost inequality, and you may get worse the credit risks independently markets credit. The FHFA would be to refuse the brand new questioned acceptance.